Optimize Your Home Funding Prospective with a Mortgage Broker Glendale CA

Optimize Your Home Funding Prospective with a Mortgage Broker Glendale CA

Blog Article

Just How a Mortgage Broker Can Assist You Browse the Complexities of Home Funding and Lending Application Procedures

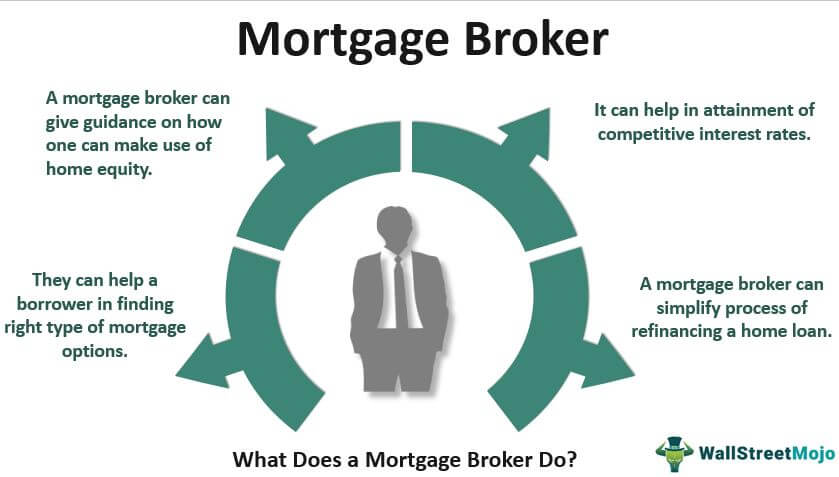

A home loan broker serves as a well-informed intermediary, furnished to improve the application process and tailor their approach to specific economic scenarios. Comprehending the full scope of how a broker can aid in this trip increases essential concerns regarding the nuances of the procedure and the prospective mistakes to avoid.

Recognizing Home Mortgage Brokers

Home loan brokers have solid partnerships with multiple lenders, providing clients access to a wider variety of home mortgage items than they could locate on their own. This network allows brokers to work out much better rates and terms, eventually benefiting the customer. Furthermore, brokers help clients in gathering necessary documentation, completing application, and ensuring compliance with the lending needs.

Benefits of Utilizing a Broker

Making use of a mortgage broker provides countless advantages that can considerably boost the home funding experience - Mortgage Broker Glendale CA. One of the primary benefits is accessibility to a more comprehensive variety of funding items from multiple lending institutions. Brokers possess comprehensive networks that permit them to existing options customized to private economic circumstances, possibly resulting in much more competitive prices and terms

Additionally, mortgage brokers offer very useful knowledge throughout the application process. Their understanding of regional market conditions and providing methods enables them to direct clients in making notified decisions. This competence can be especially helpful in browsing the paperwork demands, guaranteeing that all required documents is completed accurately and sent promptly.

An additional benefit is the capacity for time savings. Brokers handle a lot of the research, such as collecting information and liaising with lending institutions, which permits clients to concentrate on other facets of their home-buying trip. Brokers typically have developed connections with lenders, which can promote smoother settlements and quicker approvals.

Browsing Funding Choices

Browsing the myriad of finance choices readily available can be frustrating for many buyers. With different sorts of home loans, such as fixed-rate, adjustable-rate, FHA, and VA lendings, establishing the most effective suitable for one's monetary scenario needs mindful consideration. Each loan type has distinctive qualities, benefits, and potential downsides that can considerably influence long-term cost and economic stability.

A home mortgage broker plays a vital function in streamlining this process by supplying customized advice based on private situations. They have accessibility to a large selection of loan providers and can help homebuyers compare various loan products, guaranteeing they recognize the terms, rate of interest, and repayment structures. This specialist understanding can reveal options that may not be readily obvious to the typical customer, such as particular niche programs for first-time purchasers or those with special economic scenarios.

Moreover, brokers can assist in identifying the most appropriate finance quantity and term, straightening with the buyer's budget and future goals. By leveraging their knowledge, property buyers can make educated choices, prevent typical risks, and eventually, safe funding that lines up with their requirements, making the journey toward homeownership less challenging.

The Application Process

Recognizing the application process is vital for prospective property buyers intending to secure a home loan. Read More Here The home mortgage application process usually starts with gathering needed documents, such as proof of income, tax obligation returns, and details on financial debts and assets. A mortgage broker plays an essential duty in this stage, assisting customers assemble and arrange their financial files to provide a full image to lenders.

When the paperwork is prepared, the broker sends the application to numerous lending institutions on behalf of the customer. This not only enhances the procedure however additionally permits the consumer to contrast numerous loan choices efficiently (Mortgage Broker Glendale CA). The loan provider will certainly after that conduct a complete evaluation of the application, that includes a credit score check and an assessment of the consumer's monetary security

This is where a mortgage broker can look at here supply indispensable support, making sure that all demands are dealt with promptly and precisely. By navigating this intricate process, a home mortgage broker helps consumers prevent possible mistakes and attain their home financing objectives efficiently.

Lasting Financial Support

One of the crucial advantages of working with a home mortgage broker is the arrangement of lasting financial support customized to private conditions. Unlike conventional lending institutions, mortgage brokers take an alternative strategy to their clients' monetary wellness, considering not only the prompt lending demands yet also future monetary objectives. This strategic planning is necessary for homeowners who intend to keep economic stability and develop equity gradually.

Home mortgage brokers analyze different elements such as earnings stability, credit rating, and market patterns to advise the most suitable loan products. They can also offer recommendations on refinancing alternatives, pop over to these guys potential financial investment possibilities, and strategies for financial debt administration. By establishing a long-lasting connection, brokers can assist clients navigate changes in rates of interest and property markets, making sure that they make notified decisions that line up with their developing monetary needs.

Verdict

In verdict, involving a home mortgage broker can substantially alleviate the complexities associated with home financing and the lending application procedure - Mortgage Broker Glendale CA. Inevitably, the assistance of a mortgage broker not just simplifies the instant process but also offers important long-term financial advice for consumers.

Home mortgage brokers have strong relationships with multiple lending institutions, offering clients access to a broader array of home loan products than they might locate on their very own.Additionally, mortgage brokers give very useful advice throughout the financing application procedure, helping customers comprehend the nuances of their funding options. In general, a home mortgage broker offers as a well-informed ally, streamlining the home mortgage experience and improving the possibility of safeguarding positive car loan terms for their customers.

Unlike standard lenders, home mortgage brokers take a holistic approach to their customers' financial health and wellness, considering not just the immediate finance requirements yet likewise future economic goals.In verdict, engaging a home loan broker can greatly ease the complexities connected with home funding and the lending application procedure.

Report this page